Just when the food delivery industry seemed to have reached its peak, Zomato announced a transformative shift in its corporate identity. The company’s decision to rebrand its parent entity as Eternal Ltd marks a significant departure from its roots as a food delivery platform. This strategic move signals their broader ambitions to diversify beyond food delivery and establish themselves as a comprehensive technology conglomerate.

As Zomato (or Eternal) navigates this transition, market analysts and industry experts are closely how this bold rebranding initiative might reshape their market position and future growth trajectory.

Market Context and Challenges

While India’s food delivery market has evolved significantly since 2014, reaching a valuation of $13.2 in 2023, the sector faces unprecedented challenges.

The market has witnessed a dramatic shift from explosive growth to a more mature phase, characterized by intense competition, rising operational costs, and changing consumer behaviors. The post-pandemic normalization has led to decreased order frequencies and increased price sensitivity among customers.

- Order Frequency Decline: Consumers are ordering less frequently, with demand dropping 15–20% since mid-November 2024.

- Price Sensitivity: Rising inflation and economic uncertainty have made customers more price-sensitive, forcing platforms to reduce discounts.

- Operational Costs: Logistics costs (30–35% of revenue) and marketing expenses (20–25%) are squeezing margins.

- Intense Competition: Rivals like Swiggy and Dunzo have driven price wars, eroding profitability.

Global Context: The global online food delivery market is projected to grow from $164.9 billion in 2023 to $442 billion by 2032 (CAGR of 11.58%) . However, profitability remains elusive due to high operational costs and aggressive discounting.

Food Delivery Maturity

The Indian food delivery market shows clear signs of saturation in major metropolitan areas, where customer acquisition costs have risen by 40% since 2022. With market penetration reaching 85% in tier-1 cities, companies are struggling to maintain growth rates while facing mounting pressure on profit margins.

Market Size: The Indian food delivery market grew at a 35% CAGR from 2018–2023, reaching $13.2 billion in 2023 .

Key Players: Zomato (45% market share), Swiggy (35%), and Dunzo (5%) .

Challenges:

- Order Frequency Decline: Post-pandemic normalization led to a 15–20% drop in order frequency since 2024 .

- Price Sensitivity: Rising inflation forced platforms to reduce discounts, squeezing margins .

- Operational Costs: Logistics (30–35% of revenue) and marketing (20–25%) eroded profitability

By Q3 FY25, Zomato’s food delivery segment—once a hypergrowth engine—has likely become the victim of its own success:

- Profitability Plateau: Net profit after tax (PAT) dropped 57% YoY to ₹59 crore, down from ₹138 crore in Q3 FY24.

- Revenue Growth vs. Margins: Revenue rose 64% YoY to ₹5,405 crore, but margins contracted due to expansion costs.

- Demand Slowdown: CEO Rakesh Ranjan acknowledged a “broad-based slowdown in demand” since 2024.

The food delivery market is transitioning from hypergrowth to a mature phase, volume-driven strategies are not sufficient. Zomato’s core business, accounting for 70% of revenue, became a liability. The competition between Zomato and Swiggy has resulted in a duopoly, where both players are forced to offer substantial discounts to retain market share.

Financial Performance Analysis

The details are interesting.

Zomato (Eternal)

Zomato’s Q3 FY25 results reveal a dichotomy of robust revenue growth but shrinking profitability, driven by aggressive expansion into quick commerce.

| Metric | Q3 FY25 | Q3 FY24 | Growth Rate |

|---|---|---|---|

| Revenue | ₹5,405 crore | ₹3,288 crore | 64% YoY |

| Net Profit (PAT) | ₹59 crore | ₹138 crore | -57% YoY |

| Blinkit Revenue | ₹1,399 crore | ₹644 crore (Q3 FY24) | 117% YoY |

| Gross Order Value (GOV) | ₹7,798 crore | ₹6,132 crore | 27% QoQ |

| Adjusted EBITDA | ₹285 crore | ₹125 crore | 128% YoY |

Key Insights:

- Core Business Slowdown: Food delivery revenue grew just 17% YoY, signaling market saturation .

- Blinkit’s Growth: Quick-commerce revenue surged 117% YoY, now accounting for 26% of total revenue.

- Profitability Challenges: Despite 64% revenue growth, PAT fell 57% YoY due to expansion costs and rising logistics expense.

- The company’s customer acquisition cost has increased by 25% year-over-year, while the average order value has remained relatively stagnant at ₹398.

Zomato’s Diversification Impact

- Blinkit (Quick Commerce):

- Revenue grew 21% QoQ to ₹1,399 crore in Q3 FY25, with GOV climbing 27% QoQ to ₹7,798 crore .

- Unit Economics: Blinkit’s average order value (AOV) is 20% higher than Zomato’s food delivery segment, improving margins .

- Hyperpure (B2B):

- Revenue nearly doubled YoY, serving 15,000+ restaurants with fresh supplies .

- Margin Profile: B2B operations have 15–20% higher margins than food delivery .

Swiggy

- Financials: Achieved EBITDA breakeven in Q1 FY25, with revenue growing 50% YoY.

- Strategy: Focused on Tier-2/3 cities (70% of orders) and quick-commerce (Instamart), reducing reliance on urban markets .

- Valuation: Estimated at $10.7 billion, with plans for an IPO in 2025 .

Swiggy’s Diversification Impact

- Instamart (Quick Commerce):

- Contributed 30% of total revenue in Q3 FY25, driving EBITDA breakeven .

- Tier-2/3 Focus: 60% of Instamart orders came from non-metro cities .

- Swiggy Access (Cloud Kitchens):

- Enabled 2,000+ restaurants to expand without high overheads, boosting Swiggy’s commission income .

Dunzo

- Financials: Revenue grew 30% YoY in FY24, but remained unprofitable with ₹1,200 crore in losses.

- Strategy: Focused on hyperlocal deliveries (groceries, medicines) and B2B partnerships.

Meaning…

The food delivery segment’s contribution margins have contracted from 7.5% to 6.2% during this period.

At the operational level, rising fuel costs and increased delivery partner compensation have put additional pressure on margins. These metrics indicate a maturing market where easy/hyper growth opportunities are becoming increasingly scarce.

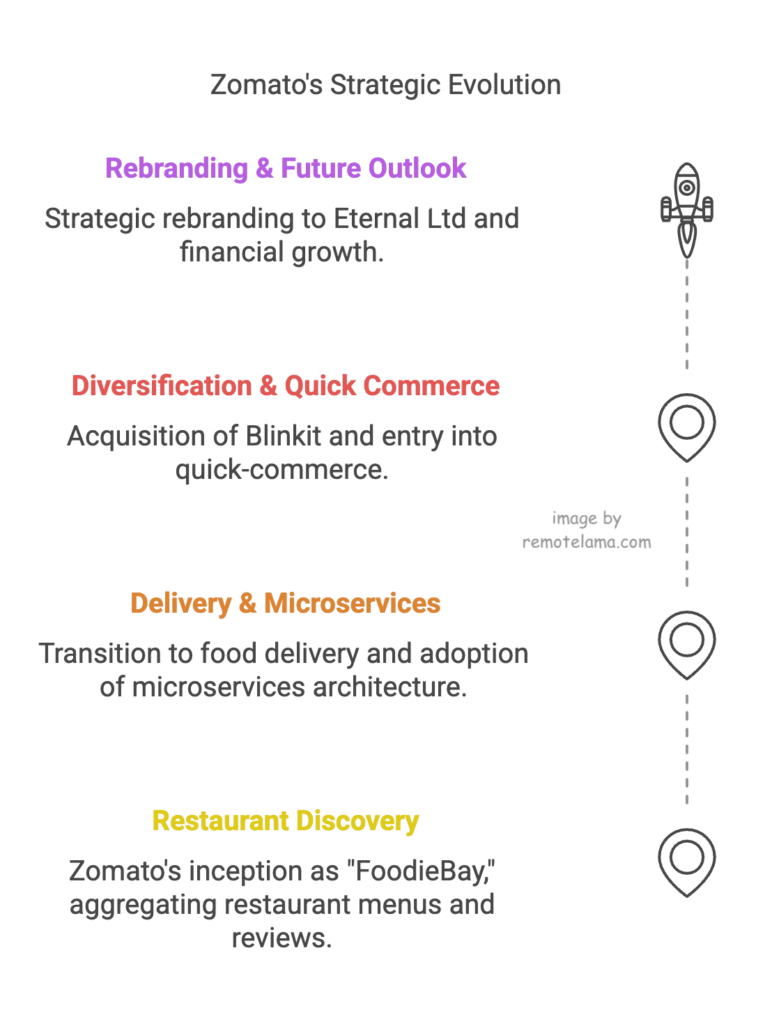

Zomato’s Architecture Evolution

Zomato’s journey from a restaurant discovery platform (2008) to a diversified tech conglomerate (2025) underscores its ability to adapt to market shifts, leverage technology, and scale operations.

Behind Eternal Ltd’s new brand architecture lies a sophisticated multi-brand strategy that maintains distinct identities for each business vertical while creating a unified corporate umbrella. The structure allows Zomato, Blinkit, Hyperpure, and District to operate independently while benefiting from shared resources and technology infrastructure. This approach has already shown positive results, with Blinkit’s revenue growing 21% QoQ in Q3 FY25, and Hyperpure nearly doubling its revenue YoY.

Corporate Identity Transformation

Along with the name change, Eternal Ltd has implemented a comprehensive corporate identity transformation that extends beyond visual elements. The company has positioned itself as a technology-first organization with a diversified portfolio, moving away from its previous image as solely a food delivery platform. This repositioning has resonated with institutional investors, as evidenced by analysts’ predictions of potential inclusion in India’s Nifty 50 index by March 2025.

- Multiple-CEO Model: Each business unit will operate semi-autonomously under dedicated CEOs, enabling focused expertise and agility .

- Example: Albinder Dhindsa (Blinkit CEO) and Rishi Arora (Hyperpure CEO) lead their respective verticals.

- Technology Integration:

- Zomato plans to leverage its logistics network and AI-driven demand forecasting to scale Blinkit’s quick-commerce operations.

- Hyperpure’s B2B model, serving 15,000+ restaurants, could expand into international markets.

Brand identity experts note that the transformation represents a significant shift in how the company presents itself to stakeholders. The new corporate identity emphasizes longevity and sustainability, reflected in CEO Deepinder Goyal’s vision of building a “lasting institution.”

Market Reaction

After the rebranding announcement, Eternal Ltd’s stock experienced a minor dip of 0.90%, reflecting short-term investor uncertainty. However, the company’s inclusion in the Nifty 50 index, predicted for March 2025, could potentially attract passive investments worth approximately $631 million, significantly boosting market capitalisation and trading volumes.

Here are some honourable mentions:

Lloyd Mathias (Angel Investor & Business Strategist):

Viewed the rebrand as a signal of growth, noting that “Eternal” helps separate Zomato’s various business arms and is a positive signal to investors .

Samit Sinha (Founder & Managing Partner, Alchemist Brand Consulting):

Argued that a long-standing association with one line of business (food delivery) can hinder diversification, which Zomato aims to address through the rebrand.

Arun Iyer (Founder, Spring Capital):

Called the rebrand a typical corporate evolution, noting that when a parent company shares its name with its flagship brand, restructuring becomes necessary as the company diversifies.

K.V. Sridhar (Founder & CCO, Hypercollective):

Emphasized that the rebrand primarily affects stakeholders and corporate entities, not consumers, and could pave the way for Zomato to expand into logistics, tech, and e-commerce.

Investor Response

About 70% of institutional investors have expressed optimism about Eternal Ltd’s diversification strategy, viewing it as a necessary evolution beyond the saturated food delivery market. The company’s expansion into quick commerce through Blinkit and B2B operations via Hyperpure has particularly resonated with long-term investors seeking exposure to India’s growing digital economy.

Indeed, major investment firms have revised their outlook on the stock, with JM Financial highlighting the reduced risk profile due to revenue diversification. The company’s ability to maintain revenue growth while pursuing strategic expansion has strengthened investor confidence in management’s execution capabilities and long-term vision.

Future Growth Trajectories

Your analysis of Eternal Ltd’s future growth potential reveals multiple expansion vectors across its diversified portfolio. With Blinkit’s revenue surge of 21% QoQ in Q3 FY25 and Hyperpure’s near doubling of revenue YoY, the company demonstrates strong momentum in its non-food delivery segments. The strategic focus on B2B operations through Hyperpure and quick commerce via Blinkit positions Eternal Ltd to capture market share in high-growth sectors while maintaining its established food delivery presence.

Global Expansion Potential

To capitalize on international markets, Eternal Ltd’s multi-vertical approach presents significant opportunities, particularly in emerging economies. The company’s successful integration of Blinkit and establishment of Hyperpure’s supply chain network in India creates a replicable model for markets with similar characteristics. Southeast Asian markets, with their dense urban populations and evolving digital consumption patterns, represent natural expansion targets for Eternal Ltd’s ecosystem of services.

Digital Innovation Roadmap

Any comprehensive evaluation of Eternal Ltd’s technology strategy indicates a clear focus on platform integration and enhanced user experience. The company’s investment in artificial intelligence and machine learning capabilities, coupled with its robust logistics infrastructure through District, positions it to develop more sophisticated delivery algorithms and personalized user experiences.

In fact, the company’s digital transformation extends beyond mere operational efficiency. With the potential consolidation of its various services into a unified platform, Eternal Ltd stands to create a seamless ecosystem where users can access food delivery, quick commerce, and other services through a single interface. This integration could significantly enhance customer retention and increase average user spending across its multiple verticals.

Final Words

The transformation of Zomato into Eternal Ltd represents a watershed moment in India’s corporate landscape that extends far beyond a mere name change. Their strategic pivot demonstrates how established companies can reinvent themselves while preserving their core strengths, as they navigate through market saturation and evolving consumer demands. The company’s bold move to diversify its portfolio through Blinkit and Hyperpure, while maintaining the trusted Zomato brand for food delivery, showcases their commitment to sustainable growth and market leadership.

The success of this rebranding initiative will ultimately depend on Eternal Ltd’s ability to execute their multi-vertical strategy while maintaining operational excellence across all business segments. As they position themselves for potential Nifty 50 inclusion and explore international markets, the company’s evolution from a food-tech platform to a diversified technology conglomerate could serve as a blueprint for other organizations facing similar growth challenges. The market’s response in the coming months will reveal whether this strategic transformation will indeed prove to be the masterstroke that propels them toward their vision of building a lasting institution.

9 min read